Grundläggande statistik

| Institutionella ägare | 159 total, 141 long only, 1 short only, 17 long/short - change of 94,12% MRQ |

| Genomsnittlig portföljallokering | 0.0044 % - change of −44,34% MRQ |

| Institutionella aktier (lång) | 72 097 479 (ex 13D/G) - change of 4,04MM shares 455,94% MRQ |

| Institutionellt värde (lång) | $ 681 890 USD ($1000) |

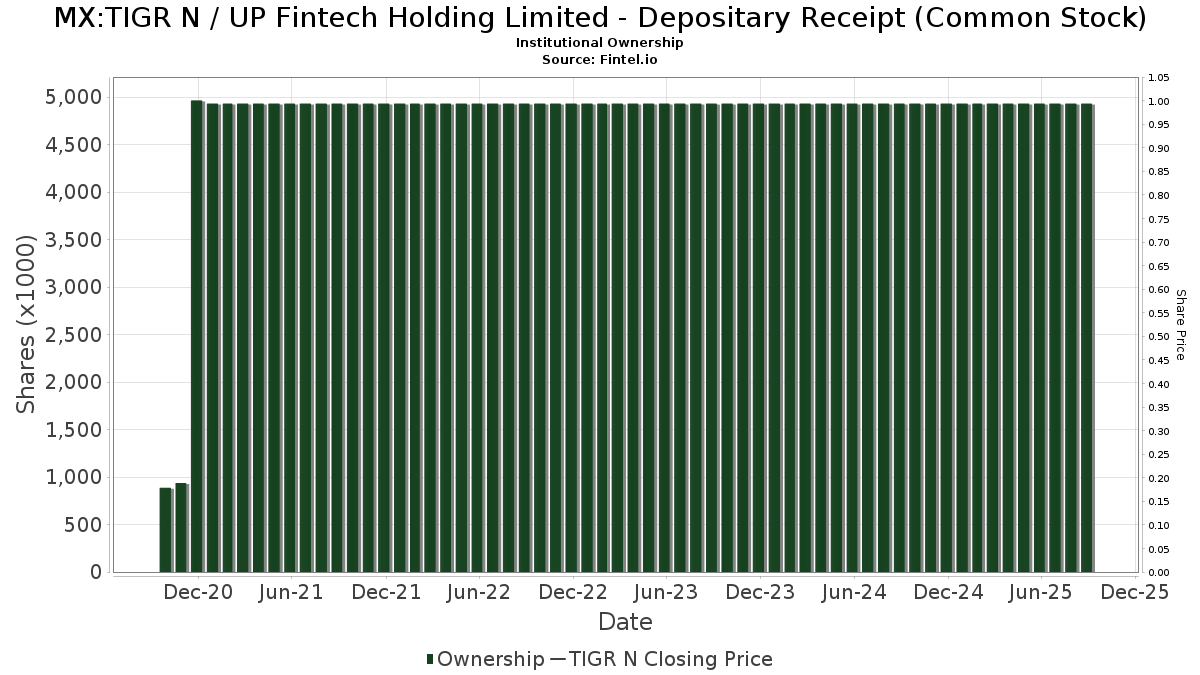

Institutionellt ägande och aktieägare

UP Fintech Holding Limited - Depositary Receipt (Common Stock) (MX:TIGR N) har 159 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 72,097,479 aktier. Största aktieägare inkluderar Avenir Tech Ltd, Susquehanna International Group, Llp, Susquehanna International Group, Llp, Sparta 24 Ltd., Jane Street Group, Llc, Jane Street Group, Llc, Group One Trading, L.p., Group One Trading, L.p., Morgan Stanley, and Walleye Trading LLC .

UP Fintech Holding Limited - Depositary Receipt (Common Stock) (BMV:TIGR N) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Renaissance Technologies Llc | 1 279 100 | 44,74 | 12 343 | 62,62 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 1 366 700 | −26,17 | 13 | −13,33 | |||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 298 009 | 70,00 | 3 | 100,00 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 504 169 | −35,01 | 5 | −33,33 | ||||

| 2025-08-14 | 13F | Garden State Investment Advisory Services LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 1 179 200 | −8,45 | 11 | 0,00 | |||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 1 309 001 | −49,09 | 12 632 | −42,81 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | Put | 42 400 | 409 | |||||

| 2025-05-15 | 13F | Oasis Management Co Ltd. | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-30 | 13F | Wallace Advisory Group, LLC | 13 506 | −1,21 | 116 | 31,82 | ||||

| 2025-07-23 | 13F | Bingham Private Wealth, Llc | 12 752 | 21,07 | 123 | 36,67 | ||||

| 2025-08-13 | 13F | CMT Capital Markets Trading GmbH | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-13 | 13F | HighTower Advisors, LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 19 500 | 188 | ||||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 15 235 | 147 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 40 182 | 116,65 | 388 | 143,40 | ||||

| 2025-05-07 | 13F | Nkcfo Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Eschler Asset Management LLP | 41 147 | −65,71 | 397 | −61,46 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 39 600 | −40,18 | 382 | −32,75 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 19 709 | 0 | ||||||

| 2025-06-27 | NP | PGJ - Invesco Golden Dragon China ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 113 120 | 9,88 | 933 | 28,69 | ||||

| 2025-08-08 | 13F | Alberta Investment Management Corp | 10 500 | 0,00 | 101 | 12,22 | ||||

| 2025-05-15 | 13F | Dymon Asia Capital (singapore) Pte. Ltd. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Avenir Tech Ltd | Put | 610 400 | 5 890 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 4 202 | −28,92 | 41 | −20,00 | ||||

| 2025-08-14 | 13F | Avenir Tech Ltd | 10 667 581 | 296,58 | 102 942 | 345,52 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 168 900 | 1 630 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 17 | 0,00 | 0 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 68 674 | 17,95 | 663 | 32,40 | ||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | Put | 157 100 | 1 046,72 | 1 516 | 1 195,73 | |||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | Call | 7 500 | −73,21 | 72 | −70,00 | |||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | 347 213 | 25,22 | 3 351 | 40,70 | ||||

| 2025-06-23 | NP | UGPIX - UltraChina ProFund Investor Class | 4 347 | −34,91 | 36 | −25,53 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 218 480 | 21,15 | 2 108 | 36,09 | ||||

| 2025-07-24 | NP | ONEQ - Fidelity Nasdaq Composite Index Tracking Stock This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 41 806 | −33,93 | 339 | 33,46 | ||||

| 2025-08-14 | 13F | Ionic Capital Management LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 1 982 850 | 9,45 | 19 135 | 22,95 | ||||

| 2025-08-28 | NP | SPEM - SPDR(R) Portfolio Emerging Markets ETF | 121 262 | 1,93 | 1 170 | 14,59 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 7 540 500 | 26,87 | 72 766 | 42,52 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 7 587 600 | 184,55 | 73 220 | 219,67 | |||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 1 | 0,00 | 0 | |||||

| 2025-07-11 | 13F | Harbour Capital Advisors, LLC | 67 525 | −2,58 | 646 | 12,35 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 63 279 | 638,38 | 611 | 735,62 | ||||

| 2025-05-05 | 13F | Creekmur Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 110 200 | −15,30 | 1 063 | −4,83 | ||||

| 2025-08-04 | 13F | Quaker Wealth Management, LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 161 179 | −16,20 | 1 555 | −5,87 | ||||

| 2025-07-28 | NP | HROAX - FinTrust Income and Opportunity Fund Class A Shares | 75 000 | −11,76 | 608 | −1,14 | ||||

| 2025-08-05 | 13F | Claro Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Caption Management, LLC | Call | 80 000 | 0,00 | 772 | 12,37 | |||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 24 710 | 238 | ||||||

| 2025-08-25 | NP | AADR - AdvisorShares Dorsey Wright ADR ETF | 154 066 | 27,32 | 1 487 | 43,02 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 11 542 | 46 068,00 | 109 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 6 548 | −57,08 | 63 | −51,91 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | Call | 520 000 | 147,62 | 5 018 | 178,31 | |||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 2 544 456 | 19,24 | 24 554 | 33,96 | ||||

| 2025-08-14 | 13F | Canada Pension Plan Investment Board | 1 274 250 | 15,63 | 12 297 | 29,90 | ||||

| 2025-07-28 | NP | AVSE - Avantis Responsible Emerging Markets Equity ETF | 126 | 0,00 | 1 | |||||

| 2025-08-13 | 13F | Walleye Trading LLC | 1 131 801 | −12,59 | 10 922 | −1,81 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 3 514 100 | 0,85 | 33 911 | 13,30 | |||

| 2025-07-28 | NP | AVEE - Avantis Emerging Markets Small Cap Equity ETF | 5 362 | 42,04 | 43 | 59,26 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 313 660 | 98,36 | 3 027 | 122,83 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 536 300 | −27,96 | 5 175 | −19,06 | |||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 8 902 | 49,71 | 86 | 66,67 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 2 282 337 | 122,65 | 22 025 | 150,13 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 13 517 | 14,15 | 130 | 28,71 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 122 435 | 10,52 | 1 | |||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 20 000 | 193 | ||||||

| 2025-07-15 | 13F | Burns Matteson Capital Management, LLC | 26 119 | 42,57 | 252 | 60,51 | ||||

| 2025-08-14 | 13F | Lighthouse Investment Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Handelsbanken Fonder AB | 27 000 | 33,00 | 0 | |||||

| 2025-08-08 | 13F | Wrapmanager Inc | 16 149 | −3,23 | 156 | 8,39 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 59 864 | −12,36 | 1 | |||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 80 177 | 0,00 | 650 | 12,07 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 60 555 | 114,36 | 584 | 141,32 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 74 181 | 0,00 | 1 | |||||

| 2025-05-09 | 13F | Headlands Technologies LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Beverly Hills Private Wealth, LLC | 25 799 | −4,88 | 249 | 6,90 | ||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | 354 100 | 3 417 | ||||||

| 2025-08-28 | NP | QCSTRX - Stock Account Class R1 | 95 400 | 0,00 | 921 | 12,33 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 12 562 | 0,00 | 121 | 13,08 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 686 | 26,10 | 0 | |||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 280 | −84,03 | 3 | −86,67 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 106 017 | −5,88 | 1 023 | 5,79 | ||||

| 2025-08-14 | 13F | UBS Group AG | 378 458 | −38,70 | 3 652 | −31,13 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 3 247 099 | 282,08 | 31 335 | 329,23 | ||||

| 2025-08-12 | 13F | Personal Cfo Solutions, Llc | 30 668 | 6,97 | 296 | 19,92 | ||||

| 2025-08-01 | 13F | Shilanski & Associates, Inc. | 29 546 | 0,33 | 285 | 13,10 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | Put | 160 600 | −42,56 | 1 550 | −35,49 | |||

| 2025-07-25 | NP | ECNS - iShares MSCI China Small-Cap ETF | 54 346 | 22,93 | 441 | 37,50 | ||||

| 2025-08-14 | 13F | Symmetry Peak Management Llc | Call | 48 900 | 472 | |||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Legal & General Group Plc | 11 594 | 0,00 | 112 | 12,12 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 52 461 | −0,15 | 506 | 12,20 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 2 656 227 | 78,09 | 25 633 | 100,08 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 32 918 | 96,21 | 318 | 120,14 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 309 | 0,00 | 3 | 0,00 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 50 173 | 2,84 | 484 | 15,51 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 24 337 | 235 | ||||||

| 2025-05-09 | 13F | Belvedere Trading LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 72 517 | 700 | ||||||

| 2025-05-15 | 13F | Nomura Holdings Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Nuveen, LLC | 77 100 | −19,18 | 744 | −9,16 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 53 104 | −40,66 | 512 | −33,33 | ||||

| 2025-05-14 | 13F | HAP Trading, LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-09-04 | 13F | Abn Amro Investment Solutions | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 2 411 | −18,24 | 23 | −8,00 | ||||

| 2025-08-11 | 13F | Dorsey Wright & Associates | 221 433 | −38,40 | 2 137 | −30,80 | ||||

| 2025-08-28 | NP | GXC - SPDR(R) S&P(R) CHINA ETF | 14 446 | −10,17 | 139 | 0,72 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 39 195 | −98,37 | 378 | −98,17 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 359 120 | 299 166,67 | 3 466 | 346 400,00 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 546 479 | 492,32 | 5 274 | 565,78 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 133 499 | 176,68 | 1 258 | 200,72 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 937 037 | −58,64 | 9 042 | −53,54 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 351 800 | −18,77 | 3 314 | −11,75 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 235 200 | 35,64 | 2 216 | 47,37 | |||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Numerai GP LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Jump Financial, LLC | 1 346 435 | 12 993 | ||||||

| 2025-06-26 | NP | FTIHX - Fidelity Total International Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 52 505 | 32,89 | 433 | 55,76 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 2 244 778 | −7,73 | 21 662 | 3,66 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 77 314 | 2,30 | 746 | 14,95 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | Call | 1 013 500 | 71,00 | 9 780 | 92,10 | |||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | Put | 19 000 | 183 | |||||

| 2025-08-12 | 13F | Contrarius Group Holdings Ltd | 698 431 | −40,01 | 6 740 | −32,61 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 190 | −25,20 | 2 | −50,00 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 10 000 | 96 | ||||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 3 556 | −0,64 | 34 | 9,68 | ||||

| 2025-07-25 | NP | IEMG - iShares Core MSCI Emerging Markets ETF | 1 043 812 | 15,12 | 8 465 | 28,96 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 205 | 0,00 | 2 | 0,00 | ||||

| 2025-07-25 | NP | EEMS - iShares MSCI Emerging Markets Small-Cap ETF | 31 034 | 14,86 | 252 | 28,72 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 4 185 600 | 45,42 | 40 391 | 63,37 | |||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 1 988 700 | 9,92 | 19 191 | 23,48 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 1 961 751 | 125,89 | 18 931 | 153,75 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 4 390 892 | 80,47 | 42 372 | 102,74 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 256 | 0,00 | 0 | |||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 12 937 | 127 | ||||||

| 2025-08-28 | NP | SSGVX - State Street Global Equity ex-U.S. Index Portfolio State Street Global All Cap Equity ex-U.S. Index Portfolio This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 42 900 | 0,00 | 414 | 12,23 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 2 157 100 | −7,70 | 20 816 | 3,70 | |||

| 2025-08-12 | 13F | LPL Financial LLC | 91 196 | 10,00 | 880 | 23,60 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 3 491 500 | 64,05 | 33 693 | 84,29 | |||

| 2025-07-29 | 13F | Commons Capital, Llc | 23 000 | 222 | ||||||

| 2025-08-14 | 13F | Mangrove Partners | 79 771 | 770 | ||||||

| 2025-08-14 | 13F | Man Group plc | 748 503 | 532,56 | 7 223 | 610,93 | ||||

| 2025-08-28 | NP | SPGM - SPDR(R) Portfolio MSCI Global Stock Market ETF | 8 502 | 2,94 | 82 | 17,14 | ||||

| 2025-05-13 | 13F | Clear Street Markets Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-04 | 13F | AdvisorShares Investments LLC | 154 066 | 27,32 | 1 487 | 41,52 | ||||

| 2025-08-14 | 13F | Scientech Research LLC | 19 319 | 186 | ||||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 5 094 | 205,58 | 49 | 250,00 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 179 005 | −0,95 | 1 727 | 11,28 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 3 696 042 | 39,23 | 35 667 | 56,42 | ||||

| 2025-08-26 | NP | Profunds - Profund Vp Asia 30 | 54 999 | −7,23 | 531 | 4,13 | ||||

| 2025-05-13 | 13F | Central Asset Investments & Management Holdings (HK) Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 43 162 | 0,00 | 417 | 12,43 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 606 | 0,00 | 6 | 0,00 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 16 403 | 0,64 | 158 | 12,86 | ||||

| 2025-05-15 | 13F | Tairen Capital Ltd | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Two Sigma Securities, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 3 400 | 33 | ||||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Icapital Wealth Llc | 13 049 | 0,00 | 126 | 11,61 | ||||

| 2025-08-08 | 13F | Jupiter Asset Management Ltd | 2 534 300 | 24 456 | ||||||

| 2025-08-13 | 13F | Centiva Capital, LP | 123 383 | 13,41 | 1 191 | 27,41 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 37 582 | 363 | ||||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 13 168 | 22,74 | 127 | 38,04 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 57 252 | −20,13 | 553 | −10,24 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 10 662 | 103 | ||||||

| 2025-08-13 | 13F | Walleye Capital LLC | Call | 24 100 | −17,75 | 233 | −7,57 | |||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 24 824 | 123,22 | 240 | 151,58 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 239 480 | −89,17 | 2 311 | −87,84 | ||||

| 2025-07-21 | 13F/A | Point72 Asset Management, L.P. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-31 | 13F | Asset Management One Co., Ltd. | 13 749 | 15,31 | 133 | 29,41 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | Put | 11 800 | −70,20 | 114 | −66,76 | |||

| 2025-08-13 | 13F | Walleye Capital LLC | 871 831 | −6,29 | 8 413 | 5,28 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 137 | −12,18 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Alliance Wealth Advisors, LLC /UT | 14 604 | 1,40 | 141 | 13,82 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 12 701 | 0,00 | 123 | 11,93 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 65 993 | 1 | ||||||

| 2025-08-28 | NP | GMF - SPDR(R) S&P(R) EMERGING ASIA PACIFIC ETF | 10 261 | −6,52 | 99 | 5,32 | ||||

| 2025-08-01 | 13F | Belvedere Trading LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Trexquant Investment LP | 675 679 | 6 520 | ||||||

| 2025-05-14 | 13F | Peak6 Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-23 | 13F | Shell Asset Management Co | 6 828 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 166 900 | −80,96 | 1 611 | −78,61 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 18 936 | 183 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Oasis Management Co Ltd. | 0 | −100,00 | 0 | |||||

| 2025-07-22 | NP | GINN - Goldman Sachs Innovate Equity ETF | 17 869 | −64,31 | 145 | −41,22 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 32 298 | −74,49 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Diversify Wealth Management, Llc | 177 706 | 29,08 | 1 795 | 58,20 | ||||

| 2025-07-18 | 13F | Precision Wealth Strategies, LLC | 17 926 | 173 | ||||||

| 2025-08-13 | 13F | Northern Trust Corp | 182 543 | −12,13 | 1 762 | −1,29 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 2 054 300 | 220,58 | 19 824 | 260,16 | |||

| 2025-08-14 | 13F | Peak6 Llc | Call | 1 500 700 | −1,51 | 14 482 | 10,64 | |||

| 2025-08-14 | 13F | State Street Corp | 829 348 | −1,02 | 8 003 | 11,20 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 2 950 900 | 75,21 | 28 476 | 96,83 | |||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | 5 857 764 | 25,25 | 56 527 | 40,70 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 5 980 000 | 111,02 | 57 707 | 137,07 | |||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 460 203 | 4 441 | ||||||

| 2025-07-31 | 13F | Sparta 24 Ltd. | 6 260 946 | 71,20 | 60 418 | 92,33 | ||||

| 2025-08-28 | NP | EWX - SPDR(R) S&P(R) EMERGING MARKETS SMALL CAP ETF | 72 529 | −4,60 | 700 | 7,04 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 6 382 | 22,66 | 62 | 38,64 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Barclays Plc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-08 | 13F | Quinn Opportunity Partners LLC | 628 921 | 9,28 | 6 069 | 22,78 | ||||

| 2025-08-13 | 13F | CMT Capital Markets Trading GmbH | Call | 60 000 | −34,64 | 1 | ||||

| 2025-08-13 | 13F | CMT Capital Markets Trading GmbH | Put | 12 200 | −97,94 | 0 | −100,00 | |||

| 2025-08-07 | 13F | Profund Advisors Llc | 60 455 | −7,57 | 583 | 3,92 | ||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 54 651 | 42,39 | 552 | 74,37 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 245 929 | 2 373 | ||||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 19 000 | −11,21 | 183 | 0,00 | ||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-06-27 | 13F/A | Goldman Sachs Group Inc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 5 433 | 52 | ||||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 969 700 | 33,04 | 9 358 | 49,45 | |||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Call | 3 169 300 | 375,94 | 30 584 | 434,67 | |||

| 2025-08-13 | 13F | Quantbot Technologies LP | 72 680 | −29,68 | 701 | −20,97 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 309 | 0,00 | 3 | 50,00 | ||||

| 2025-05-05 | 13F | Hollencrest Capital Management | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | HAP Trading, LLC | Put | 10 200 | 1 |